UK Landfill Tax Regulations first came into being on October 1, 1996, when the United Kingdom government imposed a landfill levy on trash disposal in landfills. The tax's goal was, and continues to be, to encourage businesses and consumers to produce less trash, dispose of less garbage in landfills, and recover more value from trash unavoidably produced, such as through recycling.

in this article, we look back at the effects of those tax regulations, but not without providing the current rate of tax, lying as it does now in 2021 right now, just below £100 per tonne.

Landfill Tax rate rises to £96.70 per tonne (April 2021)

This year the UK Landfill Tax (which applies at a similar rate in each nation) has risen to £96.70.

Currently, the rate of increase is comparable to inflation. Until recently, annual increases in the standard duty rate were consistently higher than inflation.

There were 7 years in a row when the rate was increased by £8 per tonne each year. The standard-duty rate increased from £24 per tonne in 2007-08 to £80 per tonne in 2014-15.

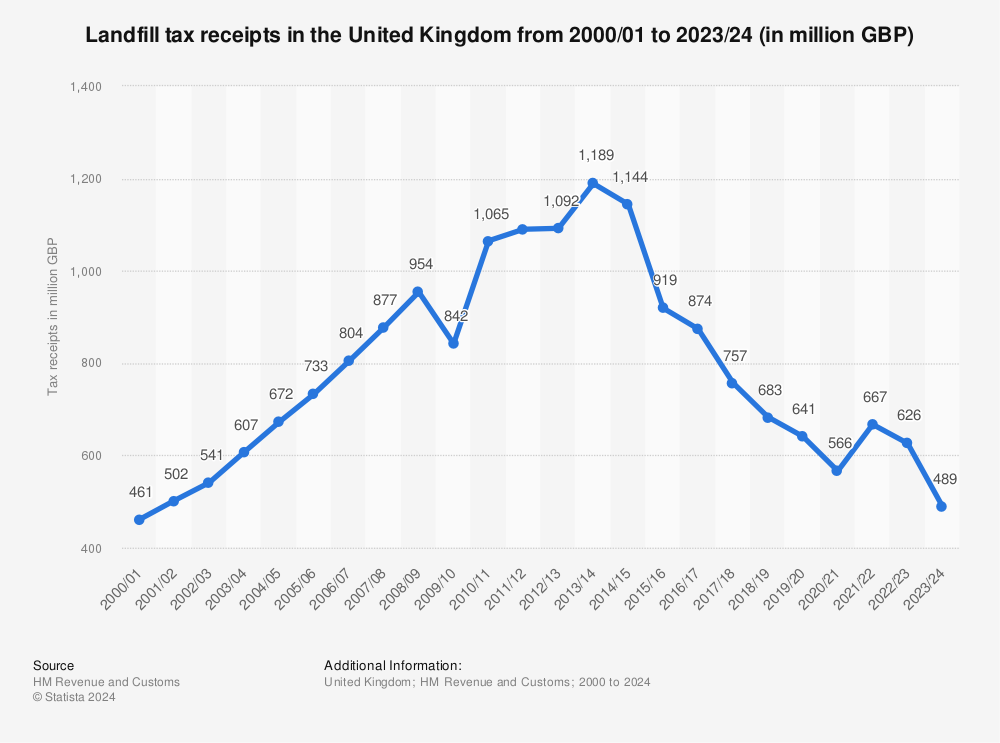

The growing then flat, and now reducing trend in landfill receipts as a percentage of GDP evident in the Statista data below, shows the effect of policy-driven increases. The effective duty rate rise initially raised the tax take.

However, as recycling became the cheaper option, reductions in waste tonnages eventually outpaced the tax rises. It would appear that reductions in the volume of garbage transported to landfills by enterprises and local governments are now steadily reducing the tax collected.

The recycling rate achieved by the public from household collections has remained fairly static over the last 5 years. So, the tax revenue reduction is clearly mostly now driven by reductions in the waste sent to landfills by the commercial and industrial sectors.

Find more statistics at Statista

The tax rise varies from one year to the next. The regular rate of landfill tax rose by £8 per tonne per year, up to and including 2014.

The rises since 2014 haven't been as dramatic, but they've been continuous.

There's also a ‘floor' under the standard rate, which prevents it from falling below £80 per tonne until at least 2020.

What is the Landfill Disposals Tax?

Landfill Disposals Tax is the Welsh equivalent of the Landfill Tax.

It tries to discourage the landfilling of materials and resources by internalizing the adverse environmental costs of landfilling waste.

The intention has been that by raising landfill costs the government will encourage more sustainable alternative outlets and treatment choices.

In effect, the tax is simply a way of internalizing the high environmental costs of landfilling waste.

Reusing and recycling materials back into the economy is good, but minimizing waste so that less needs to be disposed of in the first place, is best.

The landfill tax is now a devolved responsibility for each of the UK nation-states. This includes responsibility for determining the nature of any tax, and rates.

The Landfill Tax Regulations in England and Northern Ireland were expanded in 2018 to encompass disposals at unlicensed waste sites.

Another notable change that took effect on April 1, 2018, is that the Welsh Government now has the authority to establish the landfill tax for Wales.

It is now known as the Landfill Disposals Tax (LDT), which has been reaffirmed at the same level as the rest of the UK.

The Welsh Revenue Authority took charge of collecting and administering the Landfill Disposals Tax (LFDT), when on April 1, 2018, the Landfill Disposals Tax replaced landfill tax in Wales.

The LFDT is imposed on all taxable disposals in accordance with the Landfill Disposal Tax Act (LDTA). Until that date, the HMRC collected and processed landfill tax in Wales.

Similar processes and an approach to tax rates in all the devolved nations will provide stability and security to businesses.

This is intended to ensure that the new tax systems produced are familiar across national boundaries to those who will have to operate them on a regular basis.

Landfill Disposals Tax Community Project Funding in Wales

Within five miles of selected waste transfer facilities or landfill sites, the landfill disposals tax communities plan will fund initiatives.

Eligible sites are those that reported shipping more than 2000 tonnes to landfill in the previous reporting year.

Eligible sites are subject to change between funding rounds, so check the map before you start your application.

Landfill Tax in the News

Effect of the Coronavirus Pandemic on Landfill Volumes and Tax Take

In the period from October to December 2020, there were 290,000 tonnes of permitted disposals. This was a 41% rise over the same period in 2019.

This probably reflects increased activity as the (covid-19) restrictions imposed in March were gradually relaxed.

These landfill gate receipts resulted in a 19 percent increase over the same period last year.

However, the year-to-date results are still lower than the previous year due to weaker activity earlier in the year.

Tax tribunal rejects test cases brought by the landfill sector

The landfill sector failed to collect considerable landfill tax refunds in test cases led by Veolia, Devon Waste, and Biffa (who filed two separate appeals).

This was determined in April 2018 and is applicable to the entire industry. The tax refunds were requested on the grounds that layers of soft waste known as “fluff” were not intended to be thrown away.

Instead, they were utilized to protect the lining of waste-receiving cells at landfill sites around the United Kingdom.

What is the Landfill Tax for Inert Waste?

On October 1, 1999, the landfill tax (site restoration and quarries) order 1999 (si 1999 no. 2075) took effect, exempting around 400 inert waste landfills from the landfill tax.

In addition, inactive waste used in landfills, for their development, is exempt from paying taxes.

Expressly exempted materials from the levy are those used in site engineering or as a landfill restoration cap. A site operator must notify HMRC in writing to be eligible for the exemption.

Why was the Landfill Tax introduced?

The major goal of the landfill fee, which was initially implemented in 1996, was to make trash disposal to landfill less appealing to businesses.

This would stimulate the reduction of trash volumes and the use of alternative disposal methods that are less harmful to the environment.

Illegal trash disposal now comes with enforceable penalties and hefty punishments.

Not only will individuals guilty of illegal garbage disposal face penalties and prosecution for failing to comply with environmental regulations. But they will also be subject to the costly landfill fee.

Introduced in 1996, landfill tax encourages sustainable development and raises approximately £1 billion of revenue each year for the exchequer.

The tax is payable when waste material is disposed of at a landfill site with the amount due determined by the classification and weight of the waste material being disposed of.

A lower rate of £3. 10/tonne is payable on non-hazardous, low polluting qualifying materials including qualifying fine material deposited at authorised sites.

The introduction of landfill tax to encourage the exploration of sustainable alternatives for disposing of waste has been to an extent, successful.

Landfill Tax Statutory Instruments

UK statutory instruments with a subject of landfill tax include:

- The landfill tax (material removed from water) order 2007. 2007 no. 2909

- The landfill tax (amendment) regulations 2007. 2007 no. 965

- The landfill tax (amendment) regulations 2006. 2006 no. 865

- The landfill tax (amendment) regulations 2005. 2005 no. 759

- The landfill tax (site restoration, quarries, and pet cemeteries) order 2005.

How much Damage has the Landfill Tax Caused?

The landfill Tax has caused extensive damage to the environment and continues to do so because of fly-tipping.

The National Audit Office (NAO) discovered that higher landfill tax rates have led to persons attempting to escape payment by disposing of waste in dangerous and illegal ways.

In a report on environmental taxation, Parliament's budget inspector stated that the fee had greatly reduced the usage of landfill facilities,

“but it has also incentivised increased illegal garbage disposal.”

It claimed that between 1998 and 2014, the tax increased by 700 percent in real terms, resulting in a 65 percent reduction in waste to landfill and a doubling of tax revenue.

Unfortunately, the EA and Local Authorities have failed dismally in the prevention of fly-tipping by finding the culprits and pursuing prosecution.

This failure has been so large as to allow many fly-tippers to make large profits from doing it, without any real fear of punishment.

Is Modification of the Landfill Tax Necessary to Fight Climate Change?

Some groups are suggesting that modification of the Landfill Tax is going to be necessary to use this and other taxes in the fight against Climate Change.

The UK government has been urged to add to the purpose of the tax, a duty on carbon emissions. This might raise the landfill tax to £75 per tonne for CO2 emissions as equivalent (tCO2e) by 2035.

This would be done by broadening its scope to include emissions from trash incineration and other energy-from-waste (EfW) plants.

According to a white paper, raising this tax may bring in £27 billion by 2030.

It would be money collected that the government may then put into green technology innovation and investment.

This could include lowering the risk of early-stage deployment of carbon capture and storage in energy-from-waste (EfW) plants.

Revolutionizing Waste Recovery: Latest Separation And Sorting Innovations

Waste recovery is changing fast, thanks to new separation and sorting technology. This tech helps us sort trash better, so we can recycle more things. For example, Stadler has built a big plant in Spain for VAERSA that makes recycling easier and smarter. Keson is finding new ways to deal with old tyres, helping both […]

The Circular Economy In Fashion: Making Clothes Sustainable

Fast fashion fills our wardrobes, but most clothes end up in landfills within a year. Introducing the concept of the circular economy in fashion. It's the best hope for making our clothes sustainable. The global clothing industry creates over 92 million tonnes of waste each year, making it one of Earth's biggest polluters. A circular […]

Can You Visit a Landfill Site in the UK?

Can You Visit a Landfill Site in the UK? Have you ever wondered if you can visit a landfill site in the UK? Many people think about what happens to their rubbish after it gets taken away. So, why not go and see one? Not an old one, long since covered in soil and made […]

The Evolution of Food Waste Processing Technologies: From Wet to Waterless Biodigesters

Read on for the latest news on the development of wet and waterless biodigesters as a means of processing Food Waste. As food waste management becomes an increasingly pressing issue for environmental sustainability, the evolution of waste processing technologies has been a game-changer in how we handle organic material. For decades, the food waste processing […]